India is leading the charge for a worldwide digital payments revolution, mainly driven by the Unified Payments Interface (UPI). The platform has gone beyond expectations for millions of users, thereby making cashless transactions the norm. UPI set a new milestone in 2024 when it facilitated 17,220 crore transactions worth ₹246.82 lakh crore in total volume, which is 46% more than the previous year.

Also, the UPI India user base has shot up to more than 450 million, and the number is still climbing as the spread of smartphones and the internet is going beyond the Tier 2 and Tier 3 areas. This has brought the agenda of identifying the best payment apps in India to the forefront for both consumers and businesses. Since there is an app for all, ranging from simple money transfers to full-fledged financial management, the battle is fierce, and the customer is the real winner.

What Is a UPI App?

A UPI application is a mobile payment application that sits on top of the Unified Payments Interface (UPI), which is a real-time payment system created by the National Payments Corporation of India (NPCI). The UPI apps are customer-friendly, meaning that they connect your account with the recipient (person or business), thus allowing you to make money transfers on the go, either through a unique ID or a UPI QR code scan.

How UPI Apps Simplify Money Transfers, Bill Payments, and Online Shopping

UPI apps have revolutionized personal finance with instant, safe, and easy transactions. They are one-stop shops for money needs, offering benefits like:

- Instant Transfers: It is a click away to send money to friends or family members, and the amount is transferred from one bank account to another within just a few seconds.

- Simplified Bill Payments: They allow you to pay electricity bills, mobile recharges, and other recurring payments without visiting numerous websites or service points.

- Easy Online Shopping: The UPI feature offers a quick and secure method to complete the payment during online shopping, without the need to type out the card details. Consequently, multiple UPI platforms have occupied the top spot as the best payment app in India.

The Rise of UPI in India’s Digital Payment Landscape

The evolution of UPI is not merely technological; it signifies simplicity and convenience. Over 500 million merchants, such as small shop owners and large online businesses, have been implementing UPI, which has been a go-to payment solution. The fact that one can conduct transactions 24/7 with zero transaction costs for peer-to-peer transactions has made it the go-to choice among an overwhelming majority of the populace.

Why UPI Cashback Apps Are a Game Changer

Within the fast-paced digital payments arena, UPI cashback apps have emerged as a significant attraction for customers, drawing them back for more. Here are some of the main reasons why they stand as a game changer:

- Financial Incentives: For every transaction, users receive a certain amount of money back, facilitating a non-cash transaction.

- Encouraging Adoption: A cashback offer is a strong incentive for people to switch from traditional payment methods to UPI.

- Building Loyalty: Users want to keep using an app that rewards them regularly for the money they spend.

Why Choosing the Right Payment App Will Make a Difference

Making a wise decision to choose the best payment app is crucial in today’s digital market, which significantly influences the course of your daily financial transactions. Here’s why it is essential:

- Security Assurance: Truly the safest app in the world, it secures your financial data with features such as data encryption and multi-factor authentication.

- Transaction Reliability: In an excellent app, if a transaction fails, you will receive a prompt notification about the failure, allowing you to resolve the issue immediately.

- Enhanced Convenience: The app can also be used for various activities, such as paying bills, buying tickets, and banking; therefore, a user only needs one app to perform all these tasks.

- Personalized Features: Top apps are giving their users individually designed features and rewards that match their shopping patterns and likes.

- Customer Support: If a problem occurs during a transaction, a reliable app will have a support team in place to help you quickly and efficiently.

Key Features to Look for in the Best Payment App

When looking for the best payment app in India, here are the features to look out for:

1. Security and Reliability

An app that can be trusted is one that keeps the user safe. This can include UPI PIN security, biometrics, and 2FA. In addition, a high rate of successful payments is significant as it can eliminate the problem of failed transactions.

2. User Interface and Experience

The user interface should be very straightforward and understandable. Even a novice in mobile payments can operate a simple tool with a smooth interface without any difficulty.

3. Extra Features and Rewards

Just like the best app will be the one that is not limited to simple transfers only. The app should have the capability to provide more services like bill payments, mobile recharges, and tie-ups with online stores. Besides that, cashbacks, loyalty schemes, and other promotional incentives can be of great help to distinguish an app from the rest.

4. Merchant and Service Integration

Besides that, the number of people who install and use an app also defines its value. Ideal apps are the ones that have countless merchants on board and offer a wide range of services, starting from utility payments to ticket reservations.

5. Customer Support

Good customer support is critical when you want your problem to be resolved quickly. A fast call center or chatbot can be beneficial when things go wrong during a transaction.

Comparison Table: Top UPI Apps

| Name | Best For | Link |

| PhonePe | Everyday transactions, bill payments, and offline purchases. | https://www.phonepe.com/ |

| Google Pay (GPay) | Simple peer-to-peer transfers and bill payments. | https://play.google.com/store/apps/details?id=com.google.android.apps.nbu.paisa.user&hl=en_IN |

| Paytm | An all-in-one app for payments, shopping, and bookings. | https://paytm.com/ |

| BHIM | Secure and basic UPI experience with no ads. | https://www.bhimupi.org.in/ |

| Amazon Pay | Amazon consumers and shoppers interested in earning combined rewards. | https://www.amazon.in/amazonpay/home |

| CRED | Credit card management and high-credit-score consumers. | https://play.google.com/store/apps/details?id=com.dreamplug.androidapp&hl=en_IN |

| MobiKwik | Wallet-based transactions and users seeking a BNPL solution. | https://play.google.com/store/apps/details?id=com.mobikwik_new&gl=IN |

| Navi | Anyone looking for a one-stop financial app that combines payments with features in lending and investing. | https://navi.com/ |

| ICICI iMobile Pay | Those who require both a UPI app and an all-inclusive mobile banking solution. | https://www.icicibank.com/mobile-banking/imobile |

| HDFC PayZapp | HDFC Bank customers and anyone who prefers fast, one-click payments. | https://www.hdfcbank.com/personal/ways-to-bank/mobilebanking/payzapp |

| Axis Easy Pay | Customers who need a very reliable and lightweight UPI application. | https://easypay.axisbank.co.in/ |

| WhatsApp Pay | Instant transfers among family and friends on WhatsApp. | https://www.whatsapp.com/payments/in |

Best Payment Apps in India (2025) – UPI Apps List

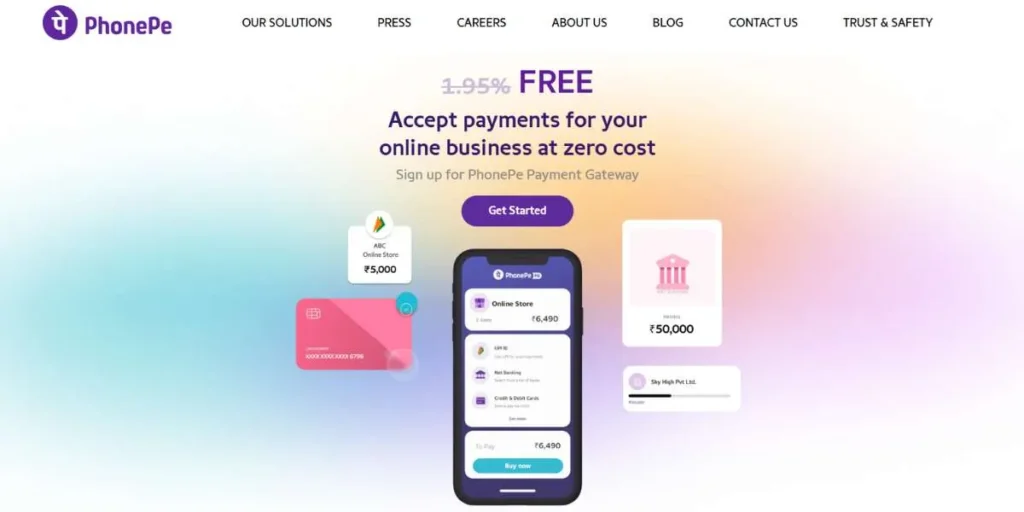

1. PhonePe

PhonePe is the best payment app in India, where it has a market share of almost 46.5% of the total transaction volume till June 2025, as per NPCI data. With more than 600 million registered users, the app is the gateway to several billion transactions every month. Additionally, PhonePe continues to provide more services in the form of mobile and DTH recharges, bill payments, and investing in gold and mutual funds. Moreover, it facilitates UPI Lite for fast, minor-value transactions and an extensive merchant base, making it one of the most widely used payment apps in India today.

- Key Features: UPI Lite, FASTag recharges, and credit score checks are part of a large number of services. It also has investment and insurance products.

- Pros: Extremely high success rate of transactions, large user base, end-to-end features, and the ability to make payments from multiple bank accounts.

- Cons: The user interface sometimes can be overloaded with a large number of options, and the customer service is usually slow, with automated responses.

- Best For: Everyday transactions, bills, and offline payments.

- Link: https://www.phonepe.com/

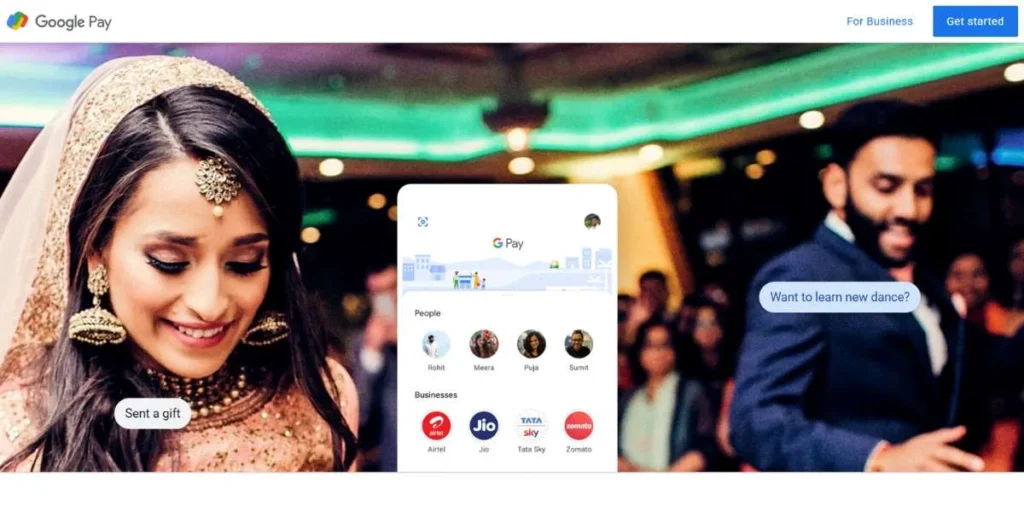

2. Google Pay (GPay)

Google Pay is the second-biggest UPI market player in India, holding a market share of about 35.6% as of June 2025. It has more than 67 million users and is known for its neat and simple user interface. With the app, you can make a UPI transaction, do your bill payment, and recharge your mobile. Moreover, it is very well integrated with the Google ecosystem, and its “Tap to Pay” feature makes offline payments super convenient. Besides, it comes with a chat-like interface for sending or receiving payment requests that makes the interaction more friendly, cementing its place among the most popular payment apps in India.

- Key Features: Simple UI, group payments, bill splitting, and secure transactions. Additionally, it features “Tap to Pay” for offline payments and direct bank account transfers.

- Pros: Simple aesthetic, fast and reliable transactions, solid encryption, and security features.

- Cons: Rewards by cashback have been reduced, some refunds are slow, and customers complain about unresponsive support.

- Best For: Peer-to-peer transfers, simple terms, bill payments, and an excellent user experience.

- Link: https://play.google.com/store/apps/details?id=com.google.android.apps.nbu.paisa.user&hl=en_IN

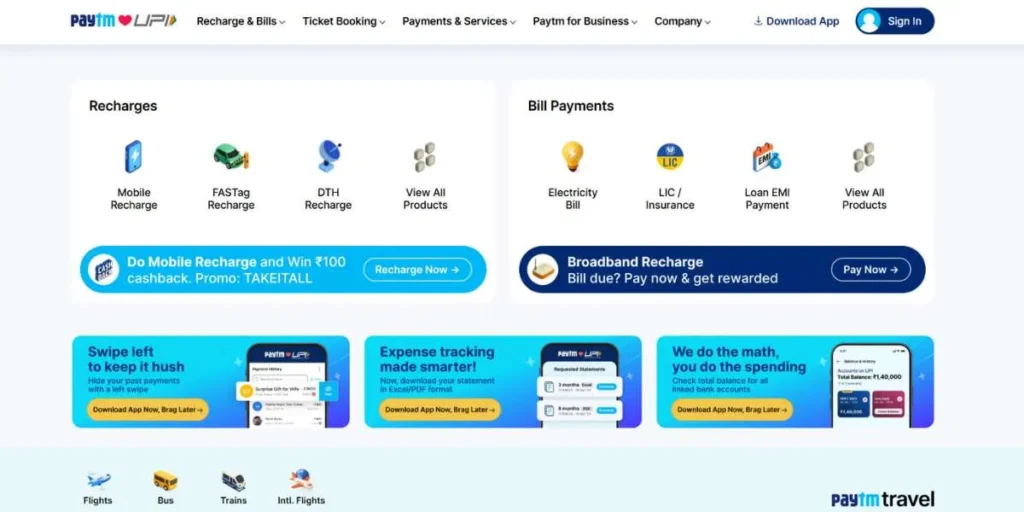

3. Paytm

Paytm is one of the most widely used digital payment apps in India with a UPI market share of 6.9% as of June 2025. The app has a lot of services in its portfolio apart from UPI, such as a wallet, booking of flights and movies, and financial services like loans and FASTag. Veteran users appreciate the app for its smooth and crash-free experience. Moreover, it is also allowed to make payments by credit card on UPI, which makes it a complete package. Recently, however, it has taken a step towards new UPI handles to become a Third-Party Application Provider (TPAP).

- Key Features: Wallet, tickets, and a vast ecosystem of services. It enables seamless credit card payments with RuPay on UPI and provides regular feature updates.

- Pros: Varied services, simple interface, and vast merchant base.

- Cons: Vulnerable to useless push notifications, and some users are complaining about untrustworthy password resets. Additionally, the chatbot’s customer service is ineffective.

- Best For: A one-stop app for payments, shopping, and bookings.

- Link: https://paytm.com/

4. BHIM (Bharat Interface for Money)

BHIM is a United Payments Interface app, an initiative by the Indian government and managed by the National Payments Corporation of India. This app, which only has a market share of 0.49%, provides users with good functionalities and an ad-free experience. Moreover, it supports more than 20 languages in India and has a feature called “Family Mode” that enables you to make a payment for someone else. In any case, for simple UPI transactions, it provides a very safe and secure platform through a clean and uncluttered UI that makes payments faster.

- Key Features: Multi-lingual, official government app, and ad-free. It also includes BHIM BillPay and a “Spend Insights” feature to track spending.

- Pros: Secure and focused on basic UPI functions. It also offers real cashback rewards without any conditions.

- Cons: Lacks advanced features and sometimes contains minor bugs. Also, users have reported that saved contacts and periodic payees may vanish suddenly.

- Best For: A simple and secure UPI experience with no ads.

- Link: https://www.bhimupi.org.in/

5. Amazon Pay

Integrated within the Amazon India app, Amazon Pay had a transaction share of 93 million in June 2025. The main usage of this facility is to pay Amazon, however, it is also possible to make UPI transfers and pay bills through it. Besides, it gets you good money-back and reward points, particularly when you shop on Amazon. Moreover, its integration with Amazon’s huge seller base makes it convenient for consumers. Also, it has RBI licenses for both a wallet and a payment aggregator, strengthening its position among the leading payment apps in India.

- Key Features: Also supported with Amazon shopping, rewards, and cashback. It supports one-click payments and allows users to conveniently track their payment history.

- Pros: Convenient payments for Amazon purchases and great rewards. It offers 24/7 support and supports multiple languages.

- Cons: It is slow and occasionally lags, and its usability is limited beyond Amazon. Also, the wallet option does not allow money to be sent to bank accounts.

- Best For: Amazon consumers and shoppers interested in earning combined rewards.

- Link: https://www.amazon.in/amazonpay/home

6. CRED

CRED is an invitation-only fintech app for individuals with a high credit score (750+). Although its UPI share is relatively low, it processed over 150 million transactions within a single month. It’s a full-stack financial wellness app that allows you to pay credit card bills and earn rewards. Apart from that, it features expense tracking and credit tracking, making it a comprehensive tool for individuals with financial concerns. Furthermore, it offers value-added features like personal loans (CRED Cash).

- Key Features: Credit card bill payment, rewards, and credit score analysis. It offers expenditure analysis graphs to help you spend money more effectively and reminders to prevent late fees.

- Pros: Attractive and highly-rated user interface, rapid credit card bill payment, and free access to a credit score.

- Cons: Limited to high-credit-score consumers, and rewards sometimes are misleading. Moreover, customers have reported frequent payment failures on rent and credit card transactions.

- Best For: Credit card management and high-credit-score consumers.

- Link: https://play.google.com/store/apps/details?id=com.dreamplug.androidapp&hl=en_IN

7. MobiKwik

MobiKwik is one of the most prominent e-wallet players, with a market share of 23% in prepaid wallet transactions. It also launched Pocket UPI, allowing users to pay directly through UPI from their wallet without needing to connect to a bank account. It also offers financial products, such as small-ticket loans and a “Buy Now, Pay Later” facility. This makes it the best option for those seeking something beyond a payment app.

- Key Features: Wallet-based UPI, loans, and “Buy Now, Pay Later” (BNPL). It also has an option to earn interest through its “Xtra” investment feature.

- Pros: Easy-to-use and user-friendly interface, can accept credit card and bill payments, and offers instant loan approvals.

- Cons: The app has frequent advertisements, and customer support is ineffective. Customers have also complained about spurious or non-functional coupon codes.

- Best For: Wallet-based transactions and users seeking a BNPL solution.

- Link: https://play.google.com/store/apps/details?id=com.mobikwik_new&gl=IN

8. Navi

Flipkart co-founder Sachin Bansal founded Navi, and it’s a super app for finances that has left a significant mark in the digital finance space. It’s not just a UPI app, but a comprehensive platform offering a range of financial products, including instant personal loans, home loans, health insurance, and mutual fund investments. The UPI service of Navi, being NPCI-approved, is one of the fastest and user-friendly. It has been quickly growing its UPI business and has about 15-16 million active users, as estimated. Additionally, Navi has been a pioneer in adopting the “credit on UPI” feature along with banks, thus being a future-oriented participant in the market and steadily making its presence felt among emerging payment apps in India.

- Key Features: Single window for a broad portfolio of financial products. It also offers instant UPI payments with Navi UPI Lite, where users can initiate transactions without needing to enter a PIN, as well as RuPay Credit Card linking to enable UPI payments.

- Pros: Bringing investments and loans, along with payments, together in a seamless way. The app features a clean UI, a high transaction success rate, and cashback incentives on UPI transactions.

- Cons: Aggressive loan solicitations and spasmodic rewards have been the subject of complaints. The app has also encountered regulatory issues in its lending activities, resulting in a temporary ban on loan releases, which has since been lifted.

- Best For: Anyone looking for a one-stop financial app that combines payments with features in lending and investing.

- Link: https://navi.com/

9. iMobile Pay

iMobile Pay by ICICI Bank is a high-featured mobile banking and UPI app that now serves non-ICICI customers as well, and has onboarded over 10 million new customers from other banks since December 2020. Moreover, it offers over 400 banking services, including UPI payments, bill payments, and investments. It also allows users to connect different bank accounts and manage their finances in one place. Furthermore, its strong security features make it a safe choice for managing all transactions related to money.

- Key Features: Full mobile banking, extensive range of services, and strong security. It provides support for scheduling recurring payments and offers complete control over accounts, including the ability to view amounts charged and request loans.

- Pros: Comprehensive bank-level services, strong security, and seamless integration. It provides support for 2FA and SIM-based login for additional protection.

- Cons: The app may be big and slow, and loan proposals can be pushy. Additionally, there have been complaints of frequent bugs, including session timeouts and fingerprint failures.

- Best For: Those who require both a UPI app and an all-inclusive mobile banking solution.

- Link: https://www.icicibank.com/mobile-banking/imobile

10. HDFC PayZapp

Since its rebranding, HDFC PayZapp has gone through massive growth, with more than 60 million active users now. The app makes 8 percent of all the digital transactions in the country and has been awarded the Celent Model Bank Award 2024. PayZapp supports UPI payments, wallets, and one-click payments from pre-linked cards. In addition, its “Swipe to Pay” feature is a faster way for money transfer as it removes the OTP step that is usually required for card payments.

- Key Features: “Swipe to Pay,” wallet, and single payment. It features an easy-to-use and intuitive UI and is also compatible with the SmartBuy reward platform.

- Pros: Simple UI, fast transactions, and reliable cashback. It also comes with numerous features, including mobile recharge and bill payment.

- Cons: Erratic login using biometrics, and it can have too many intrusive ads. Moreover, users have complained that refunds are not added to the wallet.

- Best For: HDFC Bank customers and anyone who prefers fast, one-click payments.

- Link: https://www.hdfcbank.com/personal/ways-to-bank/mobilebanking/payzapp

11. Axis Easy Pay

Axis Easy Pay is Axis Bank’s own UPI app, accessible to anyone, not just Axis Bank account holders. It is one of the leading UPI transaction banks, going through more than 883 million transactions. Besides that, it is known for low data consumption, a high success rate, with only 0.03% of the cases when a technical failure is the cause of the transaction, and also for having a user-friendly and straightforward interface that revolves around the use of basic UPI functionalities. However, it is still an excellent alternative for anyone who is looking for a light and trustworthy app for their daily transaction.

- Key Features: Light, low data usage, and high reliability. It offers a customized UPI ID and supports universal QR codes, as well as IPO payments.

- Pros: Fast and smooth transactions with hardly any lag, and adequate security settings. It offers instant money transfers without any additional charges.

- Cons: The application prompts to update even when it is already up to date. Additionally, balance inquiries are generally inaccurate, and biometric login is inconsistent.

- Best For: Customers who need a very reliable and lightweight UPI application.

- Link: https://easypay.axisbank.co.in/

12. WhatsApp Pay

WhatsApp Pay, which has more than 500 million users in India, was created to allow users to make payments with just a few clicks as they would send a message. Its transaction volume reached nearly 57.7 million by the end of December 2024. It is a secure, on-chat UPI facility, which does not need any special application. Moreover, it is your bank account that is directly connected to, and the data is encoded from one end to the other. Nevertheless, as a result of a big user base, the service is still less popular as a payment method than other UPI apps.

- Key Features: Payment via chat within, no additional app required, and end-to-end encryption. It has regional language support and is capable of scanning QR codes shared in chats.

- Pros: Straightforward to send money to contacts. Instant transfers and no fees.

- Cons: Lack of advanced features, such as bill splitting or merchant capabilities. Furthermore, users have complained about difficulty in getting help or resolving issues, which requires stable internet access.

- Best For: Instant transfers among family and friends on WhatsApp.

- Link: https://www.whatsapp.com/payments/in

What is the Best Payment App in India?

While there isn’t a single response to what app is the best payment app in India, PhonePe is the overall winner. Its market share and its massive user base attest to its reliability and widespread acceptance.

Besides, its extensive list of services, ranging from bill payment to investment, makes it a versatile app for everyone. But its excellent success rate of transactions and long list of merchants make it a viable option for day-to-day usage.

Conclusion

Choosing the best payment app in India depends on your personal needs. For a smooth all-around experience, PhonePe or Google Pay is the way to go. If you hold a credit card, CRED would be India’s best payment app for you. If security and a minimalist experience are the priorities, then BHIM is the best option. It doesn’t matter which app you choose to use; the UPI revolution has enabled crores of individuals to facilitate financial transactions more smoothly, faster, and more securely than ever, making these platforms an essential part of the growing ecosystem of payment apps in India.

FAQs

1. Which are the best UPI apps that provide cashback?

PhonePe and Navi are suitable for cashback. PhonePe offers cashback for payments of bills and shopping, while Navi provides cashback on day-to-day UPI transactions.

2. What is the safest UPI app in India?

BHIM, Google Pay, and PhonePe are among the safest UPI applications. They have robust security features, including device binding, UPI PIN, and two-factor authentication.

3. What is the best teens’ payment app in India?

FamApp (formerly FamPay) is the number one choice for teens. It supports UPI payments, a prepaid card, and parental controls.

4. Which UPI app can be used without linking a bank account?

MobiKwik’s Pocket UPI enables you to make UPI payments using a wallet balance without linking a bank account.

5. Why should I use a UPI app rather than other payment means?

UPI apps offer peer-to-peer, real-time, 24/7, and free-of-cost transfers. They are highly secure and widely accepted, making them more convenient than cash or bank transfers.