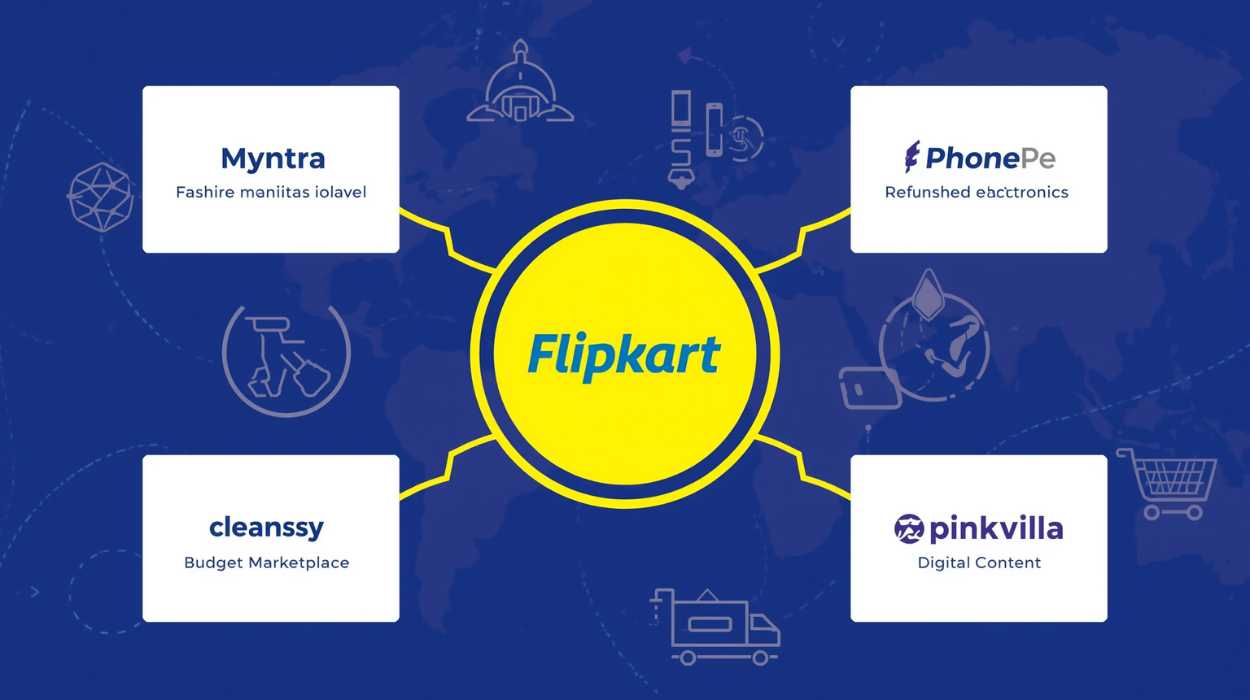

Have you ever asked yourself how Flipkart, the place where we shop all the items: phones, kitchen gadgets, etc., got so large? It is not only about the selling of items on the web. A large part of its development is through acquisition or investing in other firms. Such firms are referred to as Flipkart subsidiaries, and they are the members of a strong family, each with a different skill which makes the entire group stronger.

Think of Flipkart as the lead in a movie. The supporting cast makes the story great although the main character is strong. The top supporting cast of Flipkart are those subsidiaries. They assist Flipkart to do more than to sell goods. They deliver, process payments, sell travel tickets and even dominate online fashion.

In this paper, we will make a relaxed visit to the list of Flipkart subsidiaries. We will know who they are, what they do and why they are important to the objective of Flipkart as the best all-in-one store in India. It does not require a business background to follow. We will break it down in an amicable and easy manner. Let’s begin!

What Exactly Are Subsidiaries?

We are about to plunge into the list of Product Based Companies, but before we do so, we should first define what a subsidiary is. Think of a large, old banyan tree. The parent company is the main trunk- in this case, Flipkart. In order to expand and extend to new locations, it sends robust branches that turn into smaller, but strong trees, all linked to the trunk. The subsidiaries are the smaller trees.

A subsidiary is a firm which is dominated by another bigger parent firm. The parent often has over 50 percent of the subsidiary, which makes it the majority of the decision-making authority. Although the subsidiary is owned, it tends to retain its own name, brand and management team and is a separate entity, yet part of the larger family.

So what is the advantage of this to Flipkart? It allows the company to venture into new markets without necessarily beginning at the bottom. Flipkart can acquire an existing business rather than developing a fashion business or a payment system. This strategy means:

- Diversify services: add payments, travel, and more.

- Enter new markets fast: gain customers and expertise instantly.

- Acquire technology and talent: bring in skilled people and fresh tech.

- Lessen competition: it may be wiser to acquire a competitor than to battle.

Through the establishment or acquisition of subsidiaries, Flipkart develops a large ecosystem, a network of related services in which every component helps the others to evolve.

Meet the Stars: Top Flipkart Subsidiaries and Investments

And here is the highlight: the major players of the Flipkart family. We will check on what they do, their time of joining and what they contribute to the table.

1. Myntra

Myntra is the undisputed online fashion King in India. It is the place to visit when one wants to make purchases of clothes, shoes, and accessories online. Imagine it as the biggest online wardrobe in India, with daily clothes to the most luxurious designer brands. The platform has a reputation of a sleek interface, its wide range of brands, and its emphasis on providing a high-quality shopping experience. Myntra is not only about selling clothes, it is selling lifestyle. It relies on technology, including AI-based style suggestions, in order to make the shopping process personal and entertaining.

This firm has won the hearts of fashion-sensitive customers in the nation and it has become a market leader in the fashion industry and a force that has driven the growth of Flipkart in the high-margin apparel market, making it one of the most valuable Flipkart subsidiaries today.

- Purpose / Focus Area: Online fashion and lifestyle retail.

- Year of Acquisition / Stake: Acquired in 2014 in a landmark acquisition at a cost of approximately $270 million dollars.

- Key Features / Services: A huge range of more than 5,000 brands, personalized style recommendations, visual search, Unique brand partnership. It also possesses its own in-house brands such as Roadster and HRX.

- Impact / Value to Flipkart: Myntra brought Flipkart to the instant and commanding leader in the Indian online fashion industry. It captures another, more brand-sensitive audience and offers a high-margin source of revenue.

2. Jabong

Jabong was a top fashion retailer and then it merged with Myntra. It was a strong rival, with international brands, and with an attractive, fashionable urban appeal. Its advertisement was bold and it brought numerous global brands to the Indian market. The acquisition by Flipkart was a genius move. It gained a big customer base and eliminated a serious competitor in a single move.

The Jabong brand subsequently became entirely integrated with Myntra, but the legacy has not diminished. This acquisition cemented the market position of Flipkart in online fashion, giving it a market share unparalleled at the time and further strengthening the portfolio of Flipkart subsidiaries in the fashion space.

- Purpose / Focus Area: Fashion retailer of young, aspirational buyers online.

- Year of Acquisition / Stake: Myntra of Flipkart bought it in 2016 at a price of $70 million.

- Key Features / Services: Sells various international and high-end fashion brands, particularly in clothing, footwear and accessories.

- Impact / Value to Flipkart: The merger introduced an almost invincible grip on the online fashion industry in India as millions of fashion-sensitive consumers were united in a single roof by Flipkart.

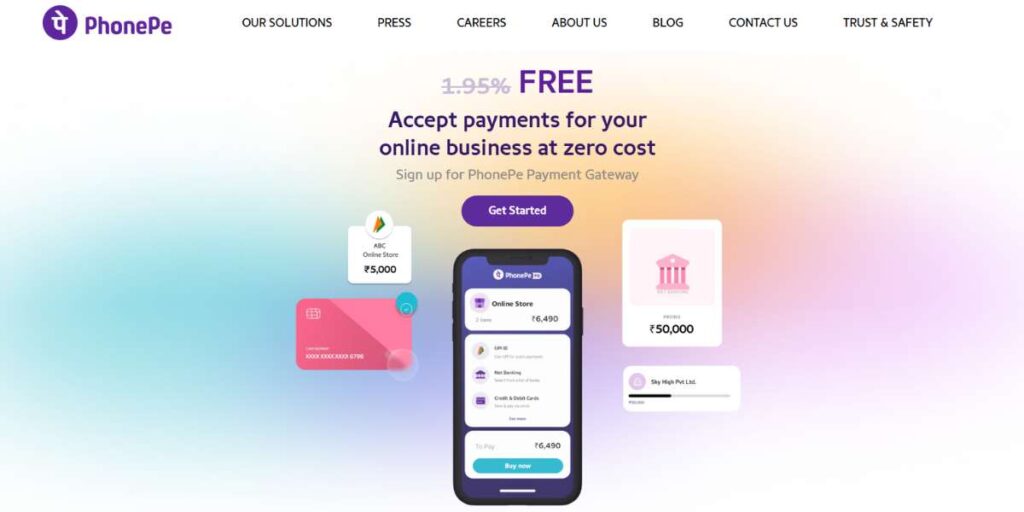

3. PhonePe

PhonePe started as a simple and safe digital-payment solution within Flipkart. It is one of the most popular fintech platforms in India today, which is well known as an app to make UPI transactions. You can pay a street hawker, pay restaurant bills, recharge your phone and purchase mutual funds with just a few taps using PhonePe. It has expanded through simplicity, security and wide adoption which are driven by the UPI revolution in India. PhonePe, though independent since 2022 to grow on its own merits and raise external capital, still has its roots well entrenched in the ecosystem of Flipkart- showing its ability to create market-shaping businesses.

- Purpose / Focus: Digital payments, financial services, and merchant services.

- Year of Acquisition/ Stake: PhonePe was launched in 2016 under Flipkart. It is currently an independent company, with Walmart as majority shareholder.

- Key features / services: UPI payments, mobile and DTH recharges, utility bill payments, insurance, mutual funds, and a business payment gateway.

- Impact / Value to Flipkart: The phonePe contributed to the development of a frictionless checkout on Flipkart, increasing the success rate of the transactions. It remains useful to the parent group even after gaining independence and demonstrates the ability of Flipkart to create unicorns.

4. Ekart Logistics

Ekart is the silent, hard working hero of Flipkart. Being the in-house logistics and supply-chain company, it ensures that orders will be delivered in time. Ekart was born as the delivery service of Flipkart and has transformed into a logistics juggernaut. It currently deals with warehousing, inventory and last-mile delivery. Ekart can be thought of as the nervous system of Flipkart, connecting sellers and buyers in thousands of pin codes in India. Ekart is efficient, and this is a major competitive advantage of Flipkart. It allows the company to provide the same-day and next-day delivery, which is crucial to customer satisfaction and loyalty. Having its own logistics network, Flipkart can regulate quality, speed, and cost, which most of the competitors cannot have.

- Purpose / Focus Area: Logistics, supply chain, warehousing, and last-mile delivery.

- Year of Acquisition / Stake: Started as an in-house logistics company of Flipkart, and formally introduced as Ekart in 2009.

- Key Features / Services: End-to-end fulfillment, cash-on-delivery processing, express delivery service and reverse logistics (processing returns). Ekart also provides these services to other business entities.

- Impact / Value to Flipkart: Ekart is the foundation of the operations of the company. It provides a stable, quick network that is necessary in the success of e-commerce, which provides Flipkart with a strategic edge to ensure that the customer experiences are consistent and of high quality.

5. Cleartrip

Flipkart did not limit itself to online selling of goods and acquired Cleartrip, which was a well-known travel site. This demonstrated the ambition of Flipkart to be a super app, one place to satisfy numerous needs. Cleartrip has a reputation of a clean, user-friendly site and therefore it is easy to book flights and hotels. Travelers in India and the Middle East have trusted it over the years.

With the entry of Cleartrip, Flipkart was fast to venture into the large online travel industry. The transformation allows Flipkart to provide travel bookings within its own application and sell these services to its high volume e-commerce clients, combining shopping and travel in one, further strengthening the list of Flipkart subsidiaries that support its super app vision.

- Purpose / Focus Area: Online travel agent (OTA).

- Year of Acquisition / Stake: 100 percent acquisition in 2021.

- Key Features / Services: Booking of flights, hotels, and holiday packages. The interface is easy to use and simple.

- Impact / Value to Flipkart: Cleartrip provides Flipkart with a good entry point in the rapidly expanding travel market. It introduces additional features to make money other than through the selling of goods, and makes Flipkart a complete super app. This keeps the users longer and returning as well.

6. Pinkvilla

lipkart’s majority stake in Pinkvilla marks a strategic move to strengthen its connection with Gen Z and millennial consumers. Known for its engaging mix of entertainment, celebrity updates, lifestyle stories, and fashion coverage, Pinkvilla brings a strong digital and social media presence into Flipkart’s ecosystem. This acquisition helps Flipkart go beyond core e-commerce and step into content-led engagement, building brand affinity and paving the way for social commerce opportunities.

As one of India’s most popular digital infotainment platforms, Pinkvilla enjoys a massive mobile-first and social-first audience base. By leveraging Pinkvilla’s content expertise, Flipkart can not only capture consumer attention but also drive higher interaction, loyalty, and conversions.

- Purpose / Focus Area: Digital infotainment & content platform

- Acquisition Year / Stake: 2025 (majority stake)

- Key Features / Services: Pinkvilla serves as a dynamic infotainment platform where advertisers can bid and place ads on mobile channels, ensuring their campaigns reach targeted and highly engaged audiences.

- Impact / Value to Flipkart: The acquisition has been pivotal in shaping Flipkart’s advertising business. By integrating Pinkvilla’s content-driven platform, Flipkart provides sellers with the ability to promote their products to a wide, engaged audience.

7. LetsShave

The investment in LetsShave is a new strategy of Flipkart: investing in potential D2C brands. LetsShave is a man and woman grooming brand that retails high quality razors, trimmers and other personal-care products. D2C brands deal directly with customers via the Internet, and they have more control over branding and customer relationships.

Flipkart does not just put a well-known label into its collection by supporting LetsShave, but also learns about the fast-growing D2C industry. This assists Flipkart to understand how these new brands work, what clients want and how to create a successful online-first brand. It also allows Flipkart to gain a portion of the D2C market through learning the industry leaders, while adding value to the growing portfolio of Flipkart owned companies.

- Purpose / Focus Area: D2C brand in the men and women grooming space.

- Year of Acquisition / Stake: Flipkart was a part of a funding round in 2020.

- Key Features / Services: Markets a variety of grooming products- such as razors, blades, shaving foams and trimmers- which it mostly sells via its own site and online marketplaces.

- Impact / Value to Flipkart: The investment will help Flipkart to be stronger in personal care and give an understanding of the D2C model. It also establishes a collaboration with an emerging brand, which will provide the possibility of special offers and further cooperation.

8. eBay India

The transaction with eBay India was a strategic and exclusive action to enter the cross-border trade. Flipkart did not acquire eBay in a simple way, but it acquired the India business of eBay and eBay invested in Flipkart. This was aimed at providing the millions of customers of Flipkart with access to sellers around the world and at the same time, providing Indian sellers with a platform to access the international customer base of eBay.

Flipkart finally shut down the eBay.in marketplace and opened their own refurbished-good site. But the alliance was a valuable trial. It provided Flipkart with experience in cross-border logistics, payments, and a better idea of international e-commerce.

- Purpose / Focus Area: E-commerce of the cross-border variety, between Indian consumers and international sellers.

- Year of Acquisition / Stake: In 2017, eBay.in was acquired by Flipkart, and eBay invested approximately 500 million dollars in Flipkart.

- Key Features / Services: The site posted the products of international eBay sellers to the Indian customers and assisted Indian sellers to export their products.

- Impact / Value to Flipkart: The acquisition gave it a strategic ally, a lot of capital, and knowledge to grow in the cross-border trade sector.

9. Meesho

The investment in Meesho shows that Flipkart has the strategy of investing in another e-commerce model. Meesho was the first social commerce in India whereby regular individuals, usually homemakers and students, become online resellers. They promote and sell products to friends and family through WhatsApp, Facebook, and Instagram and get commissions per sale. This would work well particularly in small towns and cities where personal relations and trust are important.

With its support of Meesho, Flipkart takes a portion of a rapidly developing market that is not of its own type of marketplace format. While Meesho operates independently, it is often counted among the extended companies under Flipkart that strengthen its overall presence in India’s e-commerce ecosystem.

- Purpose / Focus Area: Social commerce platform.

- Acquisition Year / Stake: Flipkart has been involved with multiple funding rounds of Meesho since 2019.

- Key Features / Services: The platform connects with suppliers and a huge number of resellers selling products through social media platforms.

- Impact / Value to Flipkart: The investment will expose Flipkart to high-growth social commerce business, which focuses on Tier 2 and Tier 3 internet users in India. It is a tactical step that would allow Flipkart to learn and gain in a different model of e-commerce.

10. Yaantra

The 2022 acquisition of Yaantra by Flipkart was a move that put the company squarely into the refurbished goods market. Yaantra is a company that deals with the repair and sale of certified, refurbished smartphones and other electronics. The Indian recommerce market is massive and very disorganized with millions of customers demanding cheap, quality-guaranteed gadgets.

With the inclusion of Yaantra, Flipkart can now provide refurbished goods with warranties, which will create trust in a market that is usually deficient. The move is a new, sustainable revenue stream and a natural follow-up to the already existing smartphone exchange programs at Flipkart, forming a fully circular electronics economy: new sales, trade-ins, and refurbished resales. This makes Yaantra one of the most strategic Flipkart acquisitions, strengthening the company’s reach in the electronics and recommerce space.

- Purpose / Focus Area: Refurbished electronics, particularly smartphones.

- Year of Acquisition / Stake: Acquired in 2022.

- Key Services/Features: Yaantra fixes, rates, and sells refurbished phones and laptops with a warranty, which offers a trusted and orderly platform of second-hand electronics.

- Impact / Value to Flipkart: Yaantra enhances the recommerce business of Flipkart, enhances the after sales services and exploits the huge market of low-cost electronics, which contributes to a more sustainable model via its exchange programs.

How It All Comes Together: The Power of the Ecosystem

As you would see, every subsidiary is a fragment of a huge puzzle. In their own right, both companies perform well. All of them together make the mighty Flipkart:

- A Smooth Customer Service: Myntra has fashion, Cleartrip has travel and Flipkart has everything. PhonePe processes payments and Ekart and Shadowfax deliver the goods. The customers are provided with an integrated experience where they are able to do nearly everything without stepping out of the Flipkart family.

- Data Synergy: The information of all these platforms provides Flipkart with an incredible insight into their customers. It understands what you like to purchase, where you like to go and how you like to pay. This information assists it in making offers personalized, enhancing services, and beating competition.

- New Revenue Streams: The subsidiaries such as Cleartrip, AdIQuity and its renovated business (through Yaantra) provide Flipkart with a whole new range of revenue streams, not just product sales.

- Strategic Moats: Flipkart operates a moat around its business by having a control over critical elements of its value chain such as logistics (Ekart) and payments (PhonePe legacy), making it extremely hard to compete with it.

What’s Next for the Flipkart Family?

The future of Flipkart and its subsidiaries is dynamic and is propelled by a number of trends. To begin with, closer integration will enhance cross-brand relationships. As an example, the booking of a flight on Cleartrip can activate personalized shopping offers on Myntra, which strengthens the intergroup synergy.

Second, Flipkart will tend to make further acquisitions. The firm is constantly scanning the promising startups in emerging areas like health-tech, ed-tech, and content streaming to build on its super-app ecosystem and make itself an essential part of the Indian consumer.

Lastly, there is a possibility of some larger subsidiaries that will follow PhonePe and issue IPOs. This would open up a lot of value to Flipkart and give it the capital that it needs to grow fast. The Flipkart family is not just growing but every member is becoming a giant.

Conclusion

Flipkart is not only an online store. It is an enormous web of businesses that expand by using intelligent acquisitions and investments. Its major Flipkart subsidiaries are Fashion (Myntra), payments (PhonePe), logistics (Ekart), and travel (Cleartrip). These collaborators make Flipkart strong, allow it to serve numerous markets, offer an unproblematic customer experience, and continue to generate new ideas.

Whenever you place an order with Flipkart or Myntra, you should take a moment to consider the formidable team of companies operating in the background. It is the tale of how to create an e-commerce powerhouse, one acquisition after another, with Flipkart subsidiaries driving the growth story.

FAQs

1. Is PhonePe owned by Flipkart?

Flipkart started PhonePe, which was then a separate company in late 2022. Walmart, the parent company of Flipkart is still the majority shareholder, hence the two businesses are closely connected.

2. What was the reason why Flipkart acquired its rival Myntra?

In 2014, Flipkart bought Myntra in order to become the fast-growing online fashion market leader. The action was an if you cannot beat them, buy them strategy and killed its largest competitor in that space.

3. What is Ekart?

Flipkart has a logistics and supply-chain division called Ekart. It handles product warehousing and, most significantly, it takes orders and delivers them to the customers at the comfort of their doorsteps, which is the backbone of the e-commerce business of Flipkart.

4. Is Flipkart a purchaser of large businesses only?

Not. The strategy of Flipkart is multifaceted. Although it buys big companies such as Myntra, it is also strategic in investing in small and fast-growing companies and firms like LetsShave and Meesho to venture into new markets.