In the modern high-tempo business sphere, the issue of invoices being managed manually has been seen to form a bottleneck to the world’s finance teams. Paper-based invoice processing is time-consuming, is subject to error on the part of human beings, and it proves to be slow in processing payments. Enter Invoice Automation took a groundbreaking product that is changing the way business is conducted in terms of accounts payable.

As the main force with the AI-driven technology in the lead in 2026, businesses have been enjoying unprecedented efficiency along with cutting the processing time by up to 90 percent and preserving the accuracy rate over 95. This all-encompassing comparison looks into the most popular invoice automation software in 2026 that will assist you in selecting the right software to use in your business.

What is Invoice Automation Software?

Definition

Invance Automation Software is a technology that can be described as an electronic application that fully automates the invoice processing cycle through artificial intelligence, optical character recognition (OCR), and machine learning. It integrates a smart, no-touch approach to automation, replacing manual data entry and workflow, and tedious work approvals, with touchless automation.

How it Works

The program will automatically extract invoice data of emails, PDFs and the scanned documents, extracts and validate the data of purchase orders, direct invoices through predetermined approval processes, and openly integrates with ERP systems to process payments without human intervention.

Ideal Users

How AI Can Automate Invoice Processing

- Smart Data Extraction: With AI based OCR, data of invoices can be read and extracted in any format with 90-95% accuracy and automatic data entry is removed altogether.

- Smart Invoice Coding: These algorithms use machine learning methods to provide recommendations automatically on correct general ledger codes and cost centers on any particular invoice based on its historical performance.

- Automated Matching: AI accurately matches invoices, purchase orders, and receipts three-way, identifying any discrepancy immediately, which needs to be reviewed.

- Predictive Approval Routing: This is an option where the system is informed by previous approvals to automatically route invoices to the appropriate personnel by the amount, department, or vendor.

- Fraud Detection: AI-based high-order algorithms help in detecting spending patterns, duplication of invoices, suspicious amounts, as well as in vetting vendors in real-time.

- Ongoing Improvement: The software has continuing learning capabilities, and the more your business invoicing is processed, the smarter it becomes and the more accurate the results.

Top Invoice Automation Software & Tools (2026 List)

| Name | Platform | Key Feature | Free/Paid | Best For |

| Rillion | Cloud-based | AI-powered invoice capture (90% accuracy) | Paid | Mid-market companies with multi-entity operations |

| HighRadius | Cloud-based | 95% accuracy with straight-through processing | Paid | Large enterprises with high invoice volumes |

| Tipalti | Cloud-based | Global payments in 120+ currencies | Paid | Companies with international supplier networks |

| BILL (Bill.com) | Cloud-based | Smart invoice capture with AI | Paid | Small to mid-sized businesses |

| Quadient | Cloud-based | Modular AP automation solution | Paid | Growing mid-market companies |

| Basware | Cloud-based | AI trained on 2+ billion invoices | Paid | Global enterprises with complex workflows |

| SAP Concur | Cloud-based | Integrated travel and expense management | Paid | Enterprises needing unified spend management |

| Coupa | Cloud-based | Comprehensive spend management platform | Paid | Large organizations with procurement needs |

| Sage Intacct | Cloud-based | Cloud-based financial management | Paid | Mid-sized businesses needing full ERP |

| Ramp | Cloud-based | Free plan available with bill pay | Free/Paid | Startups and small businesses |

Top 10 Invoice Automation Software & Tools (2026)

1. Rillion

Rillion is a rapid and versatile AI-based Invoice Automation Software that targets finance departments that need to process invoices touchlessly. Invoice data entry and coding on the platform is done by the embedded AI with an accuracy of about 90 percent, the system anticipates the best approvals routes, and the payments will continue running without human intervention. It can also be easily connected with more than 50 mainstream ERP applications like NetSuite, Sage, Microsoft Dynamics, and SAP, which is why it is well suited to companies that can oversee various entities or sites through a single dashboard.

Key Features:

- AI-powered invoice capture

- 3-way PO matching

- Personalizable approval processes.

- Virtual card payments

- Multi-entity management

Pricing:

- Necessary: Custom pricing against the invoice volume.

- Clinical: AI automation and analytics.

- Premium: Expert-service enterprise.

- All plans contain unlimited users and entities.

Best For: Multi entity companies with middle-income status.

Website: https://www.rillion.com

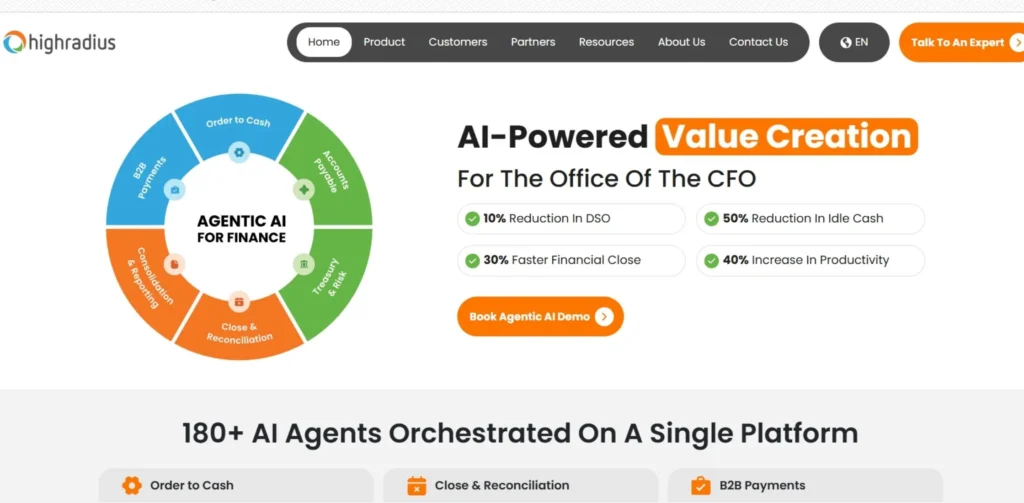

2. HighRadius

HighRadius is one of the leading invoice automation solutions available to companies that need to automate the entire AP role and reach high volumes of invoices untouched. Through the use of the agentic AI, it uses 24+ AI agents to automate the process of invoice capture, validation, coding, matching, and approval. HighRadius Entities using HighRadius achieve the highest degree of straight-through automation, 2X shorter invoice cycles, and 40 percent greater analyst efficiency, and turn accounts payable into a scalable, lean operation.

Key Features:

- 95% accuracy invoice capture

- Workflow Automated approval.

- Machine learning-driven exception management.

- Live analytics applications.

- Multi-level validation

Pricing:

- Custom enterprise pricing

- Subscription-based model

- Paid as you drive alternatives present.

- Invoice volume pricing.

Best For: Enterprise AP teams that are High volume.

Website: https://www.highradius.com

3. Tipalti

Tipalti is a global payables automation company that serves enterprises with hundreds or thousands of suppliers in more than one country. The overall platform integrates the onboarding of suppliers, invoice processing, tax compliance, and mass payment into one system. The self-service supplier portal allows vendors to personally register, send invoices, and select the most preferred method of payment among over 50 payment methods across the globe such as ACH, EFT, and SEPA, and is therefore priceless in any business that has a large number of suppliers all over the world.

Key Features:

- Global payment support

- Automated tax compliance

- Multi-entity management

- Supplier e-services.

- Pre-built ERP integrations

Pricing:

- Platform fee starts at $99/month

- Extra expense on multi-entity back-up.

- Enterprise-level price customization.

- Usage-based fees may apply

Best For: Paying its suppliers globally.

Website: https://tipalti.com

4. BILL (Bill.com)

BILL provides a low-cost cloud-based AP and AR automation targeted at small and medium businesses with either QuickBooks or Xero. The platform computerizes the invoice capture, approval processes and execution payment operations to the vendor network which enables electronic payments to be made without the need to record bank details repeatedly. Its OCR is a case of AI technology that automatically scans and processes invoice information to minimize manual transactions, and its customized workflows allow approval processes to be made to guarantee that invoices are correctly forwarded to the relevant stakeholders to deliver payments on time.

Key Features:

- Smart invoice capture

- Workflow automation: approval.

- Multiple payment options

- QuickBooks/Xero integration

- Vendor management

Pricing:

- Essentials: $45/user/month

- Team: $55/user/month

- Corporate: $79/user/month

- Enterprise: Custom pricing

Best For:Small business invoice processing.

Website: https://www.bill.com

5. Quadient (formerly Beanworks)

The Invoice Automation Software offered by Quadient assists the finance teams to computerize invoice capture, invoice approval routing, PO matching, and vendor payment in a single integrated process. It was developed on the previous Beanworks platform, which adds visibility and control to all actions of the process and enables mid-market companies to minimize errors in the process and accelerate approvals and retain full oversight of the spend. The modular strategy permits companies to go with invoice automation beginning and eventually analysis and inclusion of payment processing or management of expenses as requirement grows.

Key Features:

- Personalizable approval processes.

- 2-way and 3-way matching

- Automatization of payment calendar.

- Real-time spend reporting

- Customizable mobile approvals.

Pricing:

- Fixed-fee pricing structure

- Usage-based pricing options

- Unlimited users included

- Volume-based custom quotations.

Best For: mediocre workflow automation.

Website: https://www.quadient.com

6. Basware

Basware is an enterprise-scale AP automation system that has a trained AI on 2 billion invoices worldwide. The Intelligent Invoice Lifecycle Management Platform deals with invoice capture, workflow automation, payment processing, and supplier management of big companies with complicated demands. Basware is integrated with more than 250 ERP systems, and Basware has a global e-invoicing network consisting of over 2 million members that includes full dashboards and reporting utilities to help teams monitor KPIs and be audit prepared.

Key Features:

- Invoice automation with the use of AI.

- 250+ ERP integrations

- Global invoice compliance

- Analytics and reporting

- Procure-to-pay automation

Pricing:

- Custom enterprise pricing

- Subscription-based model

- Prices increase with invoice volume.

- Professional services were included.

Best For: Enterprise global compliance.

Website: https://www.basware.com

7. SAP Concur

SAP Concur is a cloud based solution that is a market leader in directing expenditures, travels and invoices to be more visible and controlled. Its platform has a built-in invoice capture which uses AI and intelligently reads the invoices to import data and minimise manual data entry, as well as travel booking and expense management functions. SAP Concur is currently available in intelligent flight-recommendations and automated hotel-expense breakdowns with generated AI capabilities, introduced in 2024, and as such it is especially useful when an organization needs to have a single spending-managing procedure of all its departments.

Key Features:

- AI-driven invoice capture

- In-house travel management.

- Fraud detection monitoring

- Mobile receipt capture

- Real-time expense tracking

Pricing:

- Standards: The base price is 8-12/user/month.

- Professional: Price customization.

- Enterprise: It is a volume based price.

- Average: $250/month for small businesses.

Best For: Integrated spending and traveling.

Website: https://www.concur.com

8. Coupa

Coupa is mainly a full spend management software that has advanced AP automation functionality such as invoice capture, tri-way invoice matching, and multi-level validation functionality. The platform is an AI-based system that automatically collects information on invoice and real-time location of both direct and indirect spending, which would identify and report possible fraud. Together with its procurement and sourcing solutions, Coupa assists companies to automate expenditure operations and still retain full visibility and control over all enterprise-wide spending.

Key Features:

- AI-driven invoice capture

- 3-way invoice matching

- Fraud detection system

- Procurement integration

- Spend analytics

Pricing:

- Custom enterprise pricing

- Subscription-based model

- Implementation fees apply

- User-based and module-based pricing.

Best For: Enterprise spend management.

Website: https://www.coupa.com

9. Sage Intacct

Sage Intacct is a cloud-based financial solution that provides a powerful AP all directly incorporated into the core of their platform. Being a complete ERP solution, Intacct will offer general ledger, AP, AR, cash management and financial reporting services into a single system, and avoid the complexity of integration that is characteristic of bolt-on solutions. The site provides intelligent invoice automation, which gathers information, directs approvals, and keeps audit trails, which makes it a perfect solution to small to middle-sized companies that need extensive financial management functionality rather than the processing of invoices.

Key Features:

- Financial management on clouds.

- Automated processing of the invoices.

- Multi-entity consolidation

- Real-time reporting

- General ledger integration

Pricing:

- Module based custom pricing.

- Subscription-based model

- Introduction and education expenses.

- Typically $400-1,000/month

Best For: The small business needs ERP.

Website: https://www.sage.com/en-us/sage-business-cloud/intacct/

10. Ramp

Ramp is a full-scale spend management platform, which integrates corporate cards, automation of expense control, and automation of bill payments. The best thing is that the unlimited free plan by Ramp includes invoice automation, simple approval processes, and bill payments via ACH, cards, or check, which is completely appealing to a startup and small business. The AI “Autopilot” does the repetitive bill handling, duplicate processing and automated coding using transaction history but a smooth ERP synchronization to be accurate in all systems.

Key Features:

- Free unlimited plan

- AI autopilot coding

- Corporate card integration

- Expense management

- ACH and check payments

Pricing:

- Free: Free plan unlimited may be used.

- Plus: $15/user/month

- Enterprise: Custom pricing

- Free plan- No transaction costs.

Best For: Free automation in startups.

Website: https://ramp.com

How to Automate Invoices | Step-by-step Workflow

Step 1: This will require selecting and installing Invoice Automation Software that will be used to integrate with your current ERP or accounting system.

Step 2: Advertise invoice capture locations (forwarding email addresses, direct uploads or API integrated connections) to automatically receive data.

Step 3: Accurate upkeep of vendor database containing payment terms, contact details and preferred general ledger codes to match automatically.

Step 4: Develop invoice-based or department-based or cost center and vendor-based role-based approval workflow.

Step 5: Activate automatic validation of invoices to purchase order and goods receive through the use of a three way matching rule.

Step 6: Turn on AI-enhanced code recommendations and teach the system through the performance of first sets of invoices, which would improve its accuracy.

Step 7: Automated payment plans and schedules (ACH, wire transfer, virtual cards, or checks) should be established.

Step 8: Installation of exception handling procedures on flagged invoices that need to be manually reviewed because of mismatch or anomalies.

Step 9: Make reporting dashboards to track such important metrics as processing times, approval bottlenecks, and payment schedules.

Step 10: Educate your team about the new system, develop support processes and constantly streamline work processes attributable to performance statistics.

Free vs Paid Invoice Automation Software

| Feature | Free Plans | Paid Plans |

| Invoice Volume | Limited (typically 20-50/month) | Unlimited or high volume (1,000+/month) |

| OCR Accuracy | Basic (70-80%) | Advanced AI (90-95%+) |

| Approval Workflows | Simple linear workflows | Complex multi-level customizable workflows |

| ERP Integration | Limited or none | 50+ integrations with major ERPs |

| Payment Methods | ACH only | ACH, wire, check, virtual cards, international |

| User Seats | Limited (1-3 users) | Unlimited users |

| Customer Support | Email only | 24/7 phone, email, dedicated account manager |

| Advanced Features | Not included | AI coding, fraud detection, analytics, multi-entity |

| Compliance & Security | Basic | Enterprise-grade with audit trails |

| Best For | Startups with minimal invoices | Growing to enterprise businesses |

Benefits of Using Invoice Automation Software

- Dramatic Savings in Time: The Invoice Automation Software saves time by more than 80-90 percent in processing time which enables the finance teams to process thousand-plus invoices within hours rather than days and allows the personnel to devote their time to their strategic work.

- Improved Accuracy: AI based data capture has accuracy rates of up to 90-95% effectively removing the possibility of human error to enter data, making duplicate payments, and creating expensive accounting errors that plague manual processing.

- Greater Cash Flow Visibility: Live dashboards allow real-time data of outstanding payments, payment-processing schedules and spending configurations, which allows a company to gain greater financial predictability as well as working capital management.

- Leading to Significant Cost Reduction: Firms report a reduction in the cost of invoice processing 50-70 percent of the invoice processing costs due to lowered labor requirements, the reduction in errors, and ideas/capturing of the early payment discounts lost in the past.

- Greater Compliance and Security Stronger: Automated auditing trail, role based permissions and fraud detection tools guarantee regulatory compliance as well as preventing unauthorized payment and vendor fraud schemes.

Conclusion

Invoicing Automation Software will become a luxury in 2026 but a necessity to all forms of businesses. Touchless invoice processing is now affordable and available to quite an extent because of the combination of artificial intelligence, machine learning, and cloud technology. No matter whether you are a startup launching a new product with the help of the free plan of Ramp or a big company with the extensive solution of HighRadius, the appropriate Invoice Automation Software helps cut the number of manual tasks to almost zero, enhance precision, and gain the best understanding of your business processes.

These potent instruments create a strategic competitive situation in accounts payable as the finance departments are under a rising pressure to accomplish more with less. It is no longer a question of whether or not to automate invoices, but what Invoice Automation Software is most compatible with your business.

FAQs

What is Invoice Automation Software, and how does it look?

The Invoice Automation tool is based on AI and OCR machines to automatically read, extract, validate, and process invoice data automatically. It reads invoices in different sources, routes, and payment through ERP systems.

What is the cost of the Invoice Automation tool?

The prices depend on a spectrum between free plans (e.g. Ramp) to enterprise solutions that may range between $100-500/month with small businesses, and 1,000-10,000+/month with large companies. The majority of the vendors are custom priced according to the volume of the invoice and required features.

Does the Invoice Automation Software integrate with my current accounting system?

Yes, majority of the modern Invoice Automation tool are incorporated with leading ERP and accounting software such as NetSuite, QuickBooks,Xero, SAP, Sage Intacct, Microsoft Dynamics, and Oracle. Capabilities of integration must be checked up prior to purchase.

What is the precision of the AI-assisted extraction of invoice data?

The highest-quality Invoice Automation tool has a high precision of 90-95 percent to extract data with the help of sophisticated AI and machine learning. The software corrects itself and progressively increases accuracy as it gets time and beats manual data entry considerably.

Does a small business fit Invoice Automation tool?

Absolutely! The solutions such as Ramp provide free plans to small businesses, whereas the BILL and Quadient solutions specifically target the small and mid-market companies. Automation through time savings and detection of errors is even worth processing the 50-100 invoices monthly.