The fintech ecosystem in India has revolutionized the financial industry in the country at an unprecedented pace and innovation. The Fintech market in India is expected to reach USD 44.12 billion in 2025 and grow to reach USD 95.30 billion by 2030, representing a promising 16.65% CAGR between 2025 and 2030. The fintech companies in India have transformed the way millions of Indians access the services of banking, payments, loans, insurance and investments.

With remote villages to busy cities, fintech companies in India are making financial inclusion accessible to the common person via the latest technology and a user-friendly interface. This extensive guide examines the top fintech companies in India which are transforming the digital economy in the country.

India’s Fintech Revolution

India has been the epicentre of the fintech revolution. The total valuation of Indian fintech firms is assessed at $125 billion. The Government initiatives such as Digital India, UPI (Unified Payments Interface) and Jan Dhan Yojana have provided a fertile ground where fintech companies in India continue to blossom.

The popularity of smartphones, the low cost of the internet, and the large number of unbanked people provided the right conditions that have led to the emergence of fintech firms in India as global leaders. In India, there are now over 600 million users of fintech companies through which trillions of rupees in transactions take place every year, and the industry is blazing new ground in developing innovative solutions that are being applied in other parts of the world.

Top Fintech Companies in India (2025 Edition)

Payments & UPI

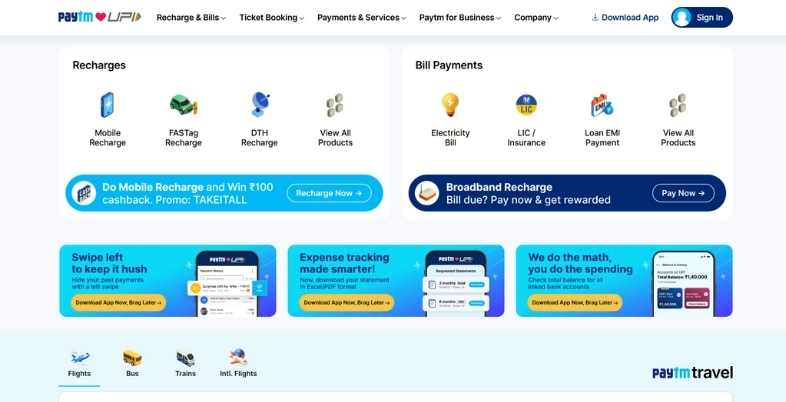

1. Paytm

Paytm is one of the most well-known fintech organizations in India that provides an end-to-end digital payments platform. Paytm was founded by Vijay Shekhar Sharma and has grown to be a full-scale fintech super app since its inception as a mobile recharge platform. Paytm remains innovative in the digital payment, QR code technology and merchant services despite the regulatory issues and market competition.

Core Services:

- UPI payments and Digital wallet

- QR code merchant payment

- Paying utility bills and top ups

- Booking of travel and entertainment

- Paytm Postpaid and lending services

Why They’re Big: The largest digital payments platform that has a broad merchant ecosystem and diversified services.

Best For: Complete digital payment and everyday payments.

Also Read: Daily 100 Rupees Earning App Without Investment

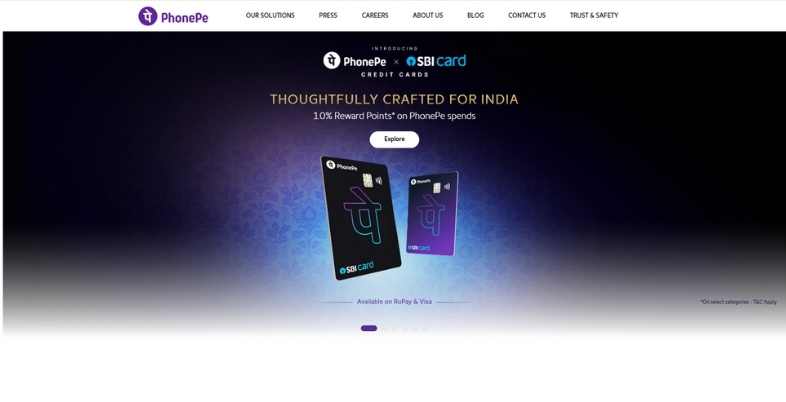

2. PhonePe

By January 2025, the company had more than 40 million merchants and more than 590 million registered users with more than 310 million online transactions per day. PhonePe is a UPI payments app that is owned by Walmart and has emerged as the most popular UPI payments app in India. The easy-to-use interface and its pushy marketing have positioned it as a default option to make digital payments in both urban and rural India.

Core Services:

- UPI money transfer and payments

- Bill Payments and Mobile recharges

- Investments in mutual funds

- Insurance products

- Investments and loans in gold

Why They’re Big: Market leader in the UPI payments that have the highest volume of transactions and users.

Best For: Digital payments and instant UPI payments.

3. Google Pay

Google Pay uses the global technology infrastructure of Google to offer a smooth payment experience in India. The platform has achieved a lot of popularity due to its integration with Google products and such innovations as tokenized payments. Google Pay is aimed at being simple and secure, so digital payments are available to first-time users.

Core Services:

- UPI transactions and payments

- Mobile top-offs and bill payments

- Proximate merchant locating

- Cashback and reward points

- Google services integration

Why They’re Big: Supported by the Google technology and ecosystem that has robust security capabilities.

Best For: Unified payment experience with Google services.

4. Razorpay

Investors in Razorpay include Peak XV Partners, Y Combinator and Tiger Global Management, which have brought in $742M in funding and the current valuation of the company stands at 4.76B – 7.97B as of 2019. Razorpay has become the best payment gateway provider in India and has been servicing all sizes of businesses. Its payment solutions cater to both online and offline businesses on a large scale and therefore become the inevitable element of the blooming e-commerce environment in India.

Core Services:

- Payment gateway products

- Point of sale systems

- Banking/Neo-banking services

- Working capital and Lending

- HR and payroll solutions

Why They’re Big: Best payment gateway provider and complete business solutions.

Best For: Business payment processing / merchant services.

Lending & Credit

5. KreditBee

KreditBee is a digital lending company in India that has established itself as one of the leaders in the fintech industry by specializing in instant loans to salaried employees and young professionals. The firm relies on sophisticated algorithms and alternative data sources to determine creditworthiness, which makes it possible to approve loans at the fastest speed. The mobile-first strategy of KreditBee has brought personal lending to be accessible to millions of Indians.

Core Services:

- Personal instant loans

- Facilities of credit line

- EMI-based lending

- Credit score check up

- Financial health tools

Why They’re Big: Largest instant loan provider with fast approval rate and competitive rates.

Best For: Immediate personal loans to the salaried professionals.

6. Capital Float

Capital Float is a company that focuses on the provision of working capital to small and medium enterprises (SMEs) in India. Capital Float is one of the first fintech companies in India to be in the B2B lending sector, which leverages technology to automate the lending business to businesses. The platform provides fixed repayment terms and fast disbursals to enable business to manage its cash flow.

Core Services:

- SMEs working capital loans

- Supply chain financing

- Invoice discounting

- Business term loans

- Revenue-based financing

Why They’re Big: The first SME lending platform in the market with unique financing products.

Best For: Working capital to small and medium sized companies.

7. MoneyTap | Fero

MoneyTap is a digital lending program that provides credit line facilities to individual consumers. One of the reasons that the company has established a niche in the fintech companies in India is through its flexible credit solutions that are similar to a credit card but on better terms. The app based platform of MoneyTap enables users to access money when they need it and charge interest only on the amount utilised.

Core Services:

- Personal line of credit facilities

- Immediate cash out

- Credit line Bill payment

- EMI at zero cost

- Improvement tools of credit score

Why They’re Big: New credit line product that allows repayment flexibility.

Best For: Individual flexible personal credit line.

Wealthtech & Investments

8. Groww

Groww is a fintech company that has democratized investing in India by opening the world of mutual funds and stock market investments to first-time investors. Millions of young investors have joined the platform due to its user-friendly interface and the educational content. Groww has made it much easier to invest and has simplified the complicated investment procedures so that more Indians can join the investment process easily.

Core Services:

- Investments in mutual funds

- Share trading

- Investment in digital gold

- Fixed deposits

- SIP and lump sum investments

Why They’re Big: The most popular investment platform that streamlines the process of investing and has good user experience.

Best For: Mutual funds and stocks investing that are suitable for beginners.

8. Zerodha

Zerodha transformed the stock trading market in India by initiating discounted stock brokerage services. With millions of active traders and investors, Zerodha has earned the trust of users as one of the most successful bootstrapped fintech companies in India. The platform has a wide variety of trading tools but keeps the costs low, which allows retail investors to explore equity investments.

Core Services:

- Discount stock brokerage

- Trading of commodities and currencies

- Investments in mutual funds

- IPO applications

- Trading in options and derivatives

Why They’re Big: India largest retail broker with innovative discount pricing model.

Best For: Active trading and investment in stocks at low commission rates.

9. Upstox

Upstox is one of the fintech firms in India that have become a powerful competitor in the discount brokerage industry. The trading platform integrates sophisticated trading technology and competitive price to appeal to active traders. Upstox provides advanced trading platforms, but is not complicated to the retail investor, and is thus popular among new traders as well as experienced traders.

Core Services:

- Internet stock trading

- Investments in mutual funds

- Trading on derivatives and options

- IPO platform

- Market and research studies

Why They’re Big: Powerful trading platform that offers competitive brokerage rates and state-of-the-art technology.

Best For: Active traders who wish to use advanced charting and analysis tools.

10. Paytm Money

Paytm Money is a wealth management company under Paytm and has been working on simplifying investment. Paytm Money is one of the fintech firms in India that has used the huge user base within the parent company to provide end-to-end investment services. The platform focuses on commission-free investing and offers a wide range of research and advisory services.

Core Services:

- Commission free mutual funds

- Investments in stocks Stock market investments

- NPS and tax saving investments

- Gold and digital.

- Portfolio advice services

Why They’re Big: Paytm ecosystem-backed commission-free investment platform.

Best For: Zero-commission mutual funds and full-service portfolio management.

Insurtech

11. PolicyBazaar

PolicyBazaar is one of the top fintech firms in India in the insurtech category that has revolutionized the insurance distribution in India. The platform has digitized the process of comparing and buying insurance to the extent that it has enabled millions of Indians to access appropriate insurance products. The transparency and easily accessible insurance have been achieved with the help of a comprehensive database and the comparison tools of PolicyBazaar.

Core Services:

- Insurance comparison and buying

- Motor, health and life insurance

- Investment-linked Insurance plans

- Claims aid services

- Renewals of insurance and managements

Why They’re Big: The largest insurance marketplace in India that provides a full product comparison.

Best For: Comparison and purchase of insurance with various providers.

12. Acko

Acko is one of the fintech companies in India that has disrupted the traditional insurance models by selling direct-to-consumer digital insurance products. The company specializes in simplified products, its prices are transparent and settlement of claims is fast. Acko has brought an insurance approach where technology is at the forefront and has made insurance accessible and easier to use by the digital natives.

Core Services:

- Online motor and bike cover

- Travel and health insurance

- Cell phone and device insurance

- Speedy pay-ups

- Insurance on a subscription basis

Why They’re Big: A digital-first insurer with innovative products and fast claim settlement.

Best For: Digital insurance products where the process is transparent pricing and fast claims.

13. Digit Insurance

Digit Insurance is a unique fintech company in India that focuses on the customer experience with regard to insurance. The company provides progressive insurance services that cater to contemporary lifestyles and online preferences. Digit has received high customer satisfaction ratings in the competitive insurance market due to its emphasis on claim experience and customer service.

Core Services:

- Full motor cover

- Travel and health insurance

- Home and online insurance

- Marine insurance

- Corporate insurance solutions

Why They’re Big: Customer oriented insurance company with advanced products and very good claim experience.

Best For: All round insurance cover with great customer service.

Neobanking

14. Jupiter

Jupiter is the new generation of neobanks in the fintech industry in India, where they provide fully digital banking services. The platform integrates conventional banking services with contemporary financial tools and spending intelligence. Jupiter is aimed at assisting users in becoming more efficient in terms of their finances by automating savings and smart spending analysis.

Core Services:

- Online savings accounts

- Automatic savings and investments

- Budgeting and cost monitoring

- UPI payments and transfers

- Individual financial information

Why They’re Big: A new generation neobank with full digital banking and financial wellness capabilities.

Best For: Banking first digital, automated savings and spending analysis.

15. Fi Money

Fi Money is a smart neobank that has established itself as one of the fintech firms in India dedicated to the enhancement of the financial health of its users. The platform integrates intelligent financial management tools into the banking services. The strategy of Fi Money focuses on financial fitness and the ability to give the user actionable feedback in order to make better financial choices.

Core Services:

- Intelligent savings accounts

- The automated financial planning

- Investment recommendations

- Alerts and bill management

- Monitoring credit score

Why They’re Big: Smart neobank that aims to make the financial health and behavior of its users better.

Best For: Intelligent banking and automated financial management and planning.

16. Niyo

Niyo has established a niche within fintech firms in India through its emphasis on salary accounts and financial wellness of employees. The platform collaborates with employers to provide better banking services to employees. Niyo has a unique model, mixing the conventional banking system with contemporary financial products tailored to the needs of salaried professionals.

Core Services:

- Salary account solutions

- International debit card

- Financial wellness of the employees

- Management of expenses tools

- Savings and investments products

Why They’re Big: Niche neobank that offers salary accounts and employee financial services.

Best For: Salary account holders who want to have more bank features and use overseas.

List of Fintech Companies in India by Category

| Category | Top Companies |

| Payments & UPI | Paytm, PhonePe, Google Pay, Razorpay |

| Lending & Credit | KreditBee, Capital Float, MoneyTap |

| Wealthtech & Investments | Groww, Zerodha, Upstox, Paytm Money |

| Insurtech | PolicyBazaar, Acko, Digit Insurance |

| Neobanking | Jupiter, Fi Money, Niyo |

Biggest Fintech Companies in India (2025)

- PhonePe (valuation: 12B; users: 400M+): Market leader in UPI transactions with 46% market share, 7 billion transactions per month worth 10 lakh crores, 400+ million registered users across 99% PIN codes in India, diversified its services to lending, insurance, and wealth management services, and has strong rural outreach with merchant network surpassing 35 million partners.

- Razorpay – $7.5B valuation, 8M+ businesses: The most popular payment gateway serving more than 8 million businesses worldwide, with a payment volume of 90 billion each year across 100+ payments methods, offering a complete range of services such as banking, lending, and payroll, has excellent international presence in Southeast Asia and other emerging markets, Tiger Global and Sequoia Capital among other marquee investors.

- Paytm – $6B valuation, 300M+ users: First mover in digital payments with 300 million registered users, largest merchant network with 26 million active merchants, a wide revenue base (payments, commerce, financial services), and brand awareness and customer loyalty despite recent troubles, Paytm is focusing on reviving its growth partly through better unit economics and compliance.

- Zerodha – Bootstrapped, 12M+ active investors: Largest retail brokerage in India with a 15% market share, 0 commission mutual funds, profitable and debt-free company without external capital, disruptive model of discount brokerage that reduced trading costs of traditional brokers, extensive focus on investor education via Varsity and other programs.

- PolicyBazaar -$3B valuation, market leader in insurance: Maintains 93% market share in online insurance aggregation, has over 50 million customers and offers 400+ insurance products, has partnered with 44+ insurance companies in life and general insurance, has a technology-first platform that provides AI-based recommendations and claim support, entering credit and lending services to create a full suite of financial services.

How to Start a Fintech Company in India

- Define Market Opportunity: Find the pain points in the Indian financial services industry and select a niche in either payments, lending, wealth management, or insurance business

- Regulatory Compliance: Acquire the required licences under RBI, SEBI or IRDAI depending on your business model; you may want to begin with the regulatory sandbox programmes given to innovative products

- Technology Infrastructure: Design scalable, secure architecture with high levels of cybersecurity, data protection, and API integrations that can be easily used to partner with banks

- Partnership Strategy: Build ties with banks, NBFCs or payment processor to get operational infrastructure; partnerships with existing financial institutions is a key to success of many fintech companies in India

- Finance and Staff: Look to raise an initial round of capital with angel investors or VCs and assemble a multi-skilled team of technology and finance experts, compliance professionals, and customer acquisition specialists

- MVP Development: Develop a minimum viable product that prioritizes core functionality, user experience, and regulatory compliance and then scale operations

- Customer Acquisition: Create affordable digital marketing solutions, referrals, and collaborations to acquire customers within the competitive Indian fintech environment

- Compliance Framework: Enforce robust KYC/AML operations, data localization, and perpetual regulatory reporting to keep the operating license intact

- Scalability Planning: Plan systems to support large number of transactions, 99.9% uptime, and security level as user base increases exponentially

Conclusion

The financial ecosystem in India has been utterly changed with the inception of fintech companies in the country, and hundreds of millions of Indians who were never served by the financial system are now able to access financial Service Based Companies. Since it is estimated that the market will reach the scale of USD 95.30 billion by 2030, the fintech businesses in India will continue their exponential progress. Whether it is payments and lending, investments and insurance, fintech firms in India have developed products that are as good as the global ones but with solutions to purely Indian problems.

The example of success of fintech companies in India shows how technology, innovation, and the profound knowledge of the market can help to build an inclusive financial system that will lead to the economic growth and prosperity of the country.

FAQs

What are the best fintech companies in India 2025?

Some of the top payments, lending, and wealth management focused fintech companies in India are PhonePe, Razorpay, Paytm, Zerodha, PolicyBazaar, Groww, and other companies focused on payments, lending, and wealth management.

How much is the value of the India fintech market in 2025?

In 2025, the India fintech market will be worth USD 44.12 billion with the market increasing by 16.65% on a CAGR basis.

How many Indian fintech unicorns exist?

There are 26 fintech unicorns in India resulting in a total market value of more than $90 billion.

What is the fastest growing fintech segment in India?

It is expected that investment tech will be the most rapidly developing fintech activity in India with a 30% growth rate over the period between 2022 and 2030.

What is it about Indian fintech firms that makes them successful in the global arena?

Indian fintech firms use their mass appeal, cutting-edge technology, low cost and in-depth knowledge of emerging market requirements to become successful globally.